5 min to read

The Original Equity Cult of India

The Making of Reliance.

The Janta Govterment

1977 George Fernandes was the Industries Minister. Now, this hard-core socialist will do something that would lay the foundation of the equity cult in India (Ya, I know, NO one would have told you this before him). The Foreign Exchange Regulation was enacted in India and all foreign companies were asked to either list their shares on the Indian bourses or quit India. Some companies like Hindustan Lever (HLL), Nestle, Colgate obliged, but others like Coca Cola quit, while some others became more Desi.

After the reinforcement of FERA in 1977, BAT started diluting their stake in ITC, reducing it by 39% in 1979. And as the political attitude was often openly hostile to the foreign influence in Larsen and Toubro. In 1977, the company ceased to have any international participation in management at all and became fully Indian. These listings of MNCs gave Indian investors an opportunity to share the wealth created by some of the best international companies. Thus a new era in equity investing in India got started and during that time.

Dhirajlal Hirachand Ambani

If you want to be lucky, be prepared. The more you prepare for a certain goal, the luckier you become. So, Dhirubhai decided to ride this Equity Wave.

Reliance Textile

The company started as an integrated modern Synthetic Yarn Processing and Synthetic Fabrics Plant at Naroda near Ahmedabad. In 1967, the first full year of production the company had recorded sales of Rs 9 million. Growth was quite good, but they needed more capital to grow.

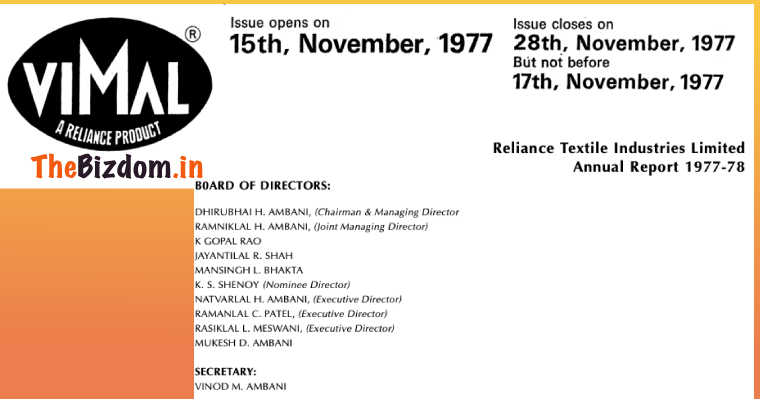

Reliance Textiles Industry went public in 1977 with an offer of 2.8 million equity shares, at Rs 10, the rules then permitting only issues at par value. With that, the company was listed in the Bombay and Ahmedabad Stock Exchanges.

Reliance Textiles Industry went public in 1977 with an offer of 2.8 million equity shares, at Rs 10, the rules then permitting only issues at par value. With that, the company was listed in the Bombay and Ahmedabad Stock Exchanges.

Dhirubhai managed to convince a large number of first-time retail investors (about 58,000) to invest in Reliance. The rest, as they say, will become history. Afterall, success is not random; it comes to those who put themselves in the right place at the right time.

The Twin Events

Dhirubhai firmly believed in keeping shareholders in a state of ecstasy – he was generous with dividends, their first dividend was of Rs. 1.50. The prices of the shares too kept pace. What had been issued at Rs 10 in 1977, grew to Rs 50 within a year of listing and by 1982 had reached a high of Rs 186.

It was going smoothly when two main events happened.

First, Pranab Mukherjee’s (then FM) allowed NRIs to invest directly into Indian equities.

Second, Few old boy Marwadi club of Kolkata thought to take PANGA. These bear operators started driving down his stocks. By 18th March selling pressure was so intense that BSE was to be closed for an hour or so. Bears sold 350000 shares, brought share price at 121 from 131.

The Maverick Dhirubhai with his own internal network got the news of the play. And, he decided to play a Poker Game. Officially he or Reliance can’t buy its own shares. He used his Gujrati network and got his brokers to start buying any Reliance shares on offer.

Bears had sold short-in i.e, they had sold shares they did not own in the expectation that the price would fall and let them pick up enough shares later at a lower price. itself could not legally. And, NRI investors based in West Asia had picked most of the physical stock (all under the eyes of Anand Jain).

In 3-4 weeks total 1.1M shares were sold & 80% of that was with Dhirubhai. On BSE, alternate Fridays used to be the settlement days, when all transactions of the last 2 weeks are cleared.

Sellers deliver shares to buyers, buyers accept delivery, or either party asks for the transaction to be postponed to the next clearance day after paying badla/compensation for the delay.

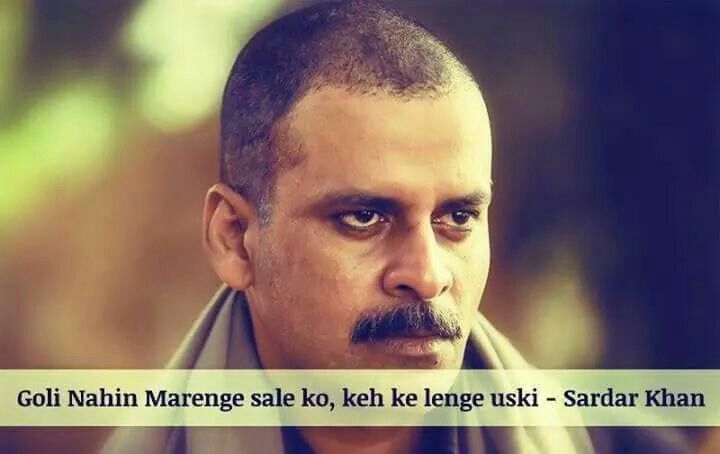

April 30, 1982, was one of those Friday. A day of total chaos in BSE history. A day when Ambani will deliver the coup de grace by demanding delivery as HIS BADLA. Ambani knew that these sellers couldn’t possibly have the shares they had sold. The panic-stricken bears’ bid for every Reliance share they can, in order to fulfil their commitments. But there was NO Seller. Ambani’s brokers also refused any postponement of the deal.

BSE had to be shut down for three days while the exchange authorities tried to bring about a compromise between the unyielding bull (Ambani) and the flustered bears. Ambani was,“Teri keh ke lunga”.

The crisis created a legend out of Ambani. The man who coined the term ‘the mega issue’ and had football stadium been booked for AGM had become India’s stock market messiah. Many more legends did follow but this was the beginning of all that.

“Manage the environment you’re in”

The Growth of Computer Age Management Services Limited

Dhirubhai once said, “between 1981 and 1985 the number of Indians owning shares increased from less than a million to four million and one in four investors was a shareholder of Reliance.” Such a large investor base – over 1.2 million by 1986, entailed plenty of paperwork. This necessitated a dedicated registrar and transfer agency. Named Reliance Consultancy Services Limited (RCS). But then RCS could barely cope. Later, when a year later, several of the debentures were converted to equity, the new shares took time to be issued and also to get listed in the various stock exchanges. This caused considerable irritation among the investor community. The time had therefore come for RCS to broad base its operations. It chose to do this by hiring agents in various cities who could handle the local requirements of investors. It was thus that CAMS was contacted, for taking care of the Madras operations. This was the beginning of CAMS!!