11 min to read

How a self-taught CA developed popular investing platforms?

Today, thousands of investors use Screener. But do you know who the folks are, running this for people like us?

Back Story

Agroha (today’s Hisar) was the capital of Agrasena, who is credited with the establishment of a kingdom of traders in North India. Agroha had 18 sub-administrative units, which later turned into 18 gotras. This translated into the surnames of the community of Agarwals in India.

Mittal is one among those. After the decline of Agroha, the majority of the Agarwals migrated towards Rajputana and Punjab. Our Mittal’s had their origin from Ambala, and in continuation of their community. Many of their family members were into the Army supplies. From Ambala, some of them shifted to Meerut and one of the branch shifted to Lucknow Cant/Sadar. Soon their grandfather got into moneylending and the flow of money got started.

In Lucknow, their father Sri Satya Prakash Mittalji was born. Money can solve problems and money can create problems. In an unfortunate turn of events, their grandfather was looted and killed by dacoits. This is when SP Mittal decided to stay away from any cash business (esp moneylending).

The search of Money Multiplier

But, he had very well understood the power of compounding (which was happening in the case of moneylending). He started looking of his own Money Multiplier, and the natural option for him was to try his luck in the equity market. Life is often full of surprises. Some surprises are pleasant, some surprises are unpleasant. Yet, some things can turn out to be the best things that happened in your life, simply because you embrace change and make the best of it.

He started in the late 1970s, and given Lucknow had no institutions for that, he would often go to the Kanpur Stock market.

He became a full-time broker by 1984, and by 1987 he was among the most active broker.

The stock market was altogether a different ball game. There was not much information available, and one must buy stocks in lots. It all began with little bets and he was using these bets with his own form of method in the madness approach.

There is no greater skill in life than making great decisions.

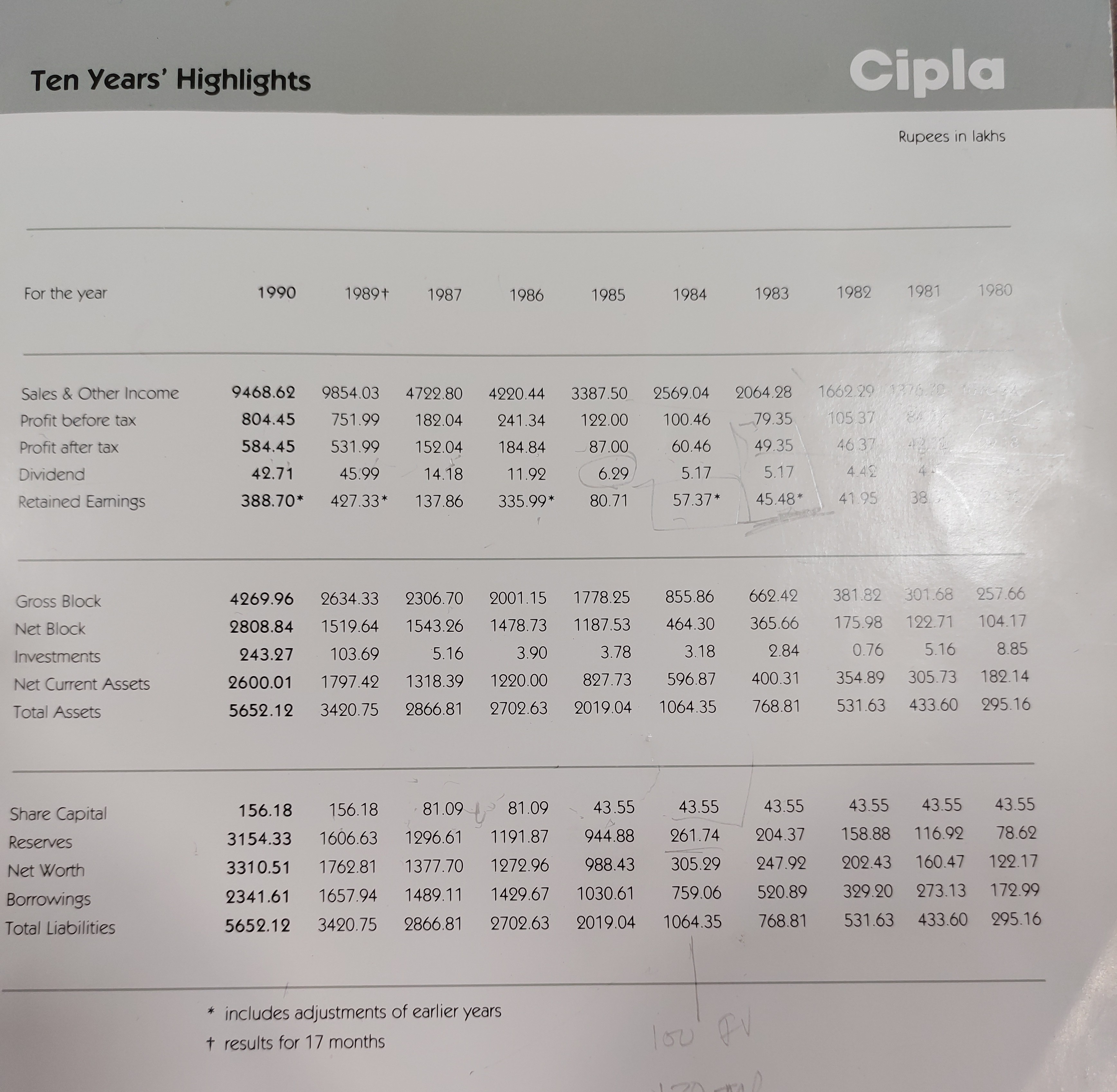

The idea was to discover better bets based on data or as Ayush Mittal says: “Find Good Unpopular Companies”. One of the early bets for them was SBI and CIPLA . And then the big moment came with DLF in 1994. As Satya Prakash Mittal put it

“Though SBI was one of the stocks we liked at that time, it was Cipla that became our first multi-multi-bagger. Fortunately, we are still holding some part of the initial holding.”

This is how senior Mittal explain his decision to go aggressive on CIPLA, just look at the breakout in the profits in 1989.

This is how senior Mittal explain his decision to go aggressive on CIPLA, just look at the breakout in the profits in 1989.

Then, by the time he passed 10th grade, Ayush had already been introduced to the rule of Stock picking. He was given the task of identifying the low PE companies, 52 weeks low, etc from magazines or business newspapers. Sometimes, making a decision you didn’t think you had in you is all it takes to live the life of your dreams. Ayush, was not very keen on picking those as his future trade and even went to Kota to be part of the Factory educational system, in his aim to become an engineer.

As they say: “Make one great decision today and it will compound over hours, days, weeks, months and years to eventually create a significant and positive impact on your life.” It all took him just a week to realize that it was better to work with PE, Price-to-book, ROCE, etc than mugging up those chemical compounds. His Mantra was to pick small companies at attractive valuations (PE in single digits, P/B of 1.5 & growth more than 20%). Someday Ayush should write a book on “How to separate short-term distractions from the real opportunities”.

In the Small-cap boom Of 2003- 2007, they made good money. Pratyush soon joined his BHAI and PAPA, having got this Equity Trading as his True North, soon after passing his 10th grade. To their pleasant surprise, his introduction brought some big disruptions!

Being an Outlier.

Outliers thrive not by seeking advantage at someone else’s expense but by creating value for themselves and others. Being an outlier also means being different from those around you. You, starts by working within your own natural abilities and gradually develops into discovering your hidden strengths. Internet is not just a place to get your daily dose of information/entertainment. While most of his friends were busy downloading nudes (on dial-up internet), he was busy hunting for multi-bagger scripts. He soon got excited about the possibilities of the tech-play in this business.

Donald Francis and the Gangs of ValuePickr

Ayush was also using the internet to meet with other stock enthusiasts. It was via such a medium, that he ended up getting connected to a gentleman named Donald Francis. He jokes, “I thought I was calling some firangi, but was surprised to hear a Hindi filmi song as the ringtone”. He holds extremely high regards for Donald, “he is extremely hard working and a brilliant researcher”. Among their closed groups, Ayush suggested Balkrishna industries as a potential multibagger. Then, Donald fired multiple questions around their fundamentals and macro environments.

Ayush got a little annoyed and told him, “why don’t you find it out yourself.”. Later Donald did amazing research on Balkrishna Industries, but it only validated the things Ayush had told him already. Both soon decided to do something for “outstanding quality research and discussion”.

As ‘Value Investors’, they are geared towards picking stocks that are currently undervalued, in other words, a stock trading at less than what it’s worth. They also try to assess the competitive strengths and weaknesses of the company to forecast whether it’s going through short-term turmoil. As they say: “Investing is not just about the past but the future.The money is made in the future and depends upon how management handles growth opportunities, not what the market price does today.” Dr Onkar Singh Ji, their mentor and a fabulous doctor, spotted Ajanta Pharma doing some very good work, which went on to be a multibagger. Mittals describe more about him

“He has been our mentor, and one of our oldest clients. He is also a wonderful doctor. “

Avanti & Shilpa Medicare were other such picks from the ValuePickr family.

Innovation is just a numbers game.

It’s easy to think that innovation is the product of a few great minds, and it happens in a flash of lightning. But the reality is that innovation is just a numbers game, the more of it you do, the better your chances of reaping the benefits.

So, when Pratyush was asked to do the manual work of short-listing companies. He thought there could be a better way. He felt the need of extracting data from the various places and then let Microsoft Excel automate certain tasks < auto-fill, auto-calculate and auto-lookup>.

“By when do you think this will be a business on it’s own?.”

Our boy had a far-stretched date. His CA teacher liked the idea and said, try to get 10k users!

Democratizing of Knowledge

We all know, knowledge is power. But then the world of capitalism doesn’t let you get that so easy. Nimesh Kampani started Capital Market in 1985. And, Prithvi Haldea started PRIME Database in 1989. But democratizing this data was still a far-off dream. This is when Screener came on May 24, 2009. Next year another set of brothers, who were also Equity-addicted-schoolboys, started Zerodha on 15th Aug, 2010. Their act of easing the experience, along with the democratising of stock selection data by Screener is in some way related to the rise of new-age-retail-investors. For many years, they depended on the member donations and then a few years back when they decided to start a paid version of it. Pratyush said:

“the expectation was to get some 100 users. But then we got way too many!”

Many of us use it for Screening for our stock Ideas. To find ideas:

- to research (stock screening),

- read the past numbers

- build a universe of stocks to research (to avoid bias)

How does it help?

One of the most boring parts about investing is learning how to read financial statements. It’s also one of the most important parts. This is where Screener helps retail investors.

- A basic understanding of ratios help you find opportunities and limit risks in an organization’s performance. Ratios are often used as a measure of liquidity, efficiency, profitability, solvency and other aspects important to the life cycle of a business.

- They also provide changes in different income statement items: Sales, Gross Margin, Operating Income and Net Income.

- A cash flow statement provides an overview of a company’s historical and projected cash flows. It is a good reflection of your financial stability and working capital management. The statement will aid you in answering questions such as: Does the company have enough cash to finance its operations? Is the timing of cash inflows right proportionate to cash outflows? What is the company’s working capital requirement?

Apart from these Financial deep-dive, the regular utility of Screener is:

- Create your watchlist: Add stocks to your watchlist to keep track of their latest announcements

- Set Screen Alerts: You can create queries to find new stock ideas. Further, you can set alerts on these queries to keep track of new results. Set Screen Alerts: You can create queries to find new stock ideas. Further, you can set alerts on these queries to keep track of new results.

- Stock name Cloning: Stock names from Big investors & Mutual Fund houses. Get the fund positions changes, portfolio holdings, etc.

- Export to Excel: this tool has empowered retail investors to run more sophisticated Ratio analysis

Today, hardly any sane investors ignore the screener page of the stock, they think of investing.

Paid membership

In the downtime of 2018, the senior Mittals, started checking for the possibilities of covereting

So, what next?

They have high regards for what platform like Tijori is doing.

“When we want to launch, we want to be useful, so we will Not make anything till it adds more value.”

So, for their own platform, they want to leverage their user base, by working on a Wiki feature. To let people also contribute and enhance the knowledge base. And yes they are also growing their own PMS, which they started in 2019.

Decisions about new investments are too often driven by emotions, like excitement, and not enough using the hard data through analytics. Markets don’t accurately discount all the information that is known about the fundamentals, but rather they may over- or underestimate that information, depending on the market’s emotional environment. A much more realistic model of how markets actually work is that prices are determined by a combination of fundamentals and emotions. As Ayush Concluded :

“Facts only help”

Bonus: Companies been invested via MITTAL ANALYTICS PRIVATE LIMITED

Note: This is just for illustration and is more than a year only information and they might NOT own any of these stocks as of now. It’s just to give an idea of their thought process.

Note: This is just for illustration and is more than a year only information and they might NOT own any of these stocks as of now. It’s just to give an idea of their thought process.